Now Reading: LLMs Disrupt Asset Management: From Research to Allocation

-

01

LLMs Disrupt Asset Management: From Research to Allocation

LLMs Disrupt Asset Management: From Research to Allocation

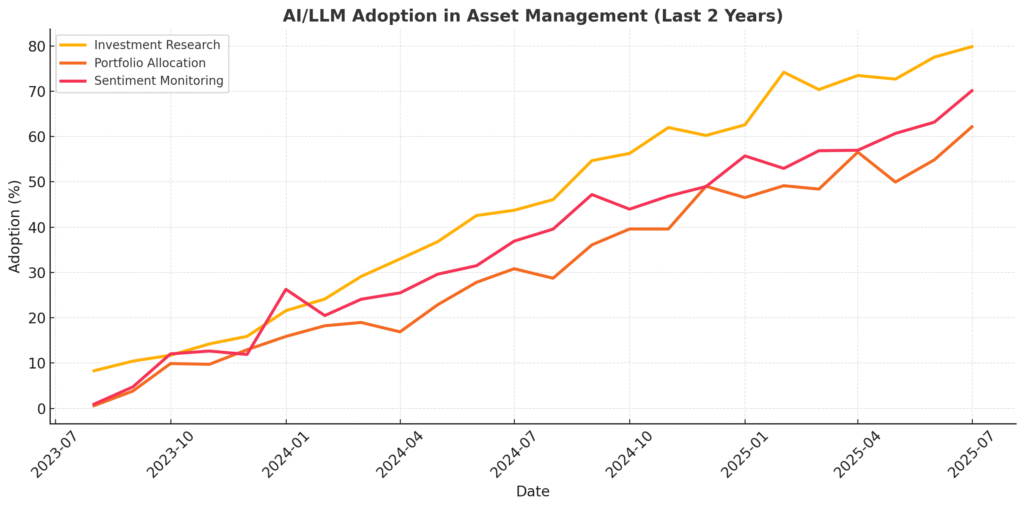

Large language models (LLMs) are increasingly embedded in the operations of leading asset managers, transforming how research is conducted and portfolios are constructed. These systems process real-time economic indicators, sentiment data, and analyst commentary to generate actionable investment insights.

At global investment firms, LLMs are being deployed to automate the synthesis of central bank commentary, extract market signals from earnings transcripts, and assess ESG risks across broad equity universes. Some platforms also integrate with portfolio optimization software to suggest reallocation strategies.

However, the technology presents risks. LLMs may misinterpret context, fabricate metrics, or amplify bias from training datasets. To mitigate these issues, asset managers are pairing AI output with human oversight, often in structured “co-pilot” workflows.

Research teams report operational efficiency gains of 50% to 70% for routine analysis. More critically, LLMs enable the discovery of cross-asset correlations that would otherwise remain obscured.

As regulators tighten scrutiny, firms are implementing governance frameworks to monitor AI behavior, maintain transparent audit trails, and test for systemic bias. If adopted responsibly, LLMs could become foundational tools in institutional investing, enhancing agility while upholding fiduciary standards.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.