Now Reading: Trump’s Tariff Threat Shakes EU Markets but France Left Vulnerable

-

01

Trump’s Tariff Threat Shakes EU Markets but France Left Vulnerable

Trump’s Tariff Threat Shakes EU Markets but France Left Vulnerable

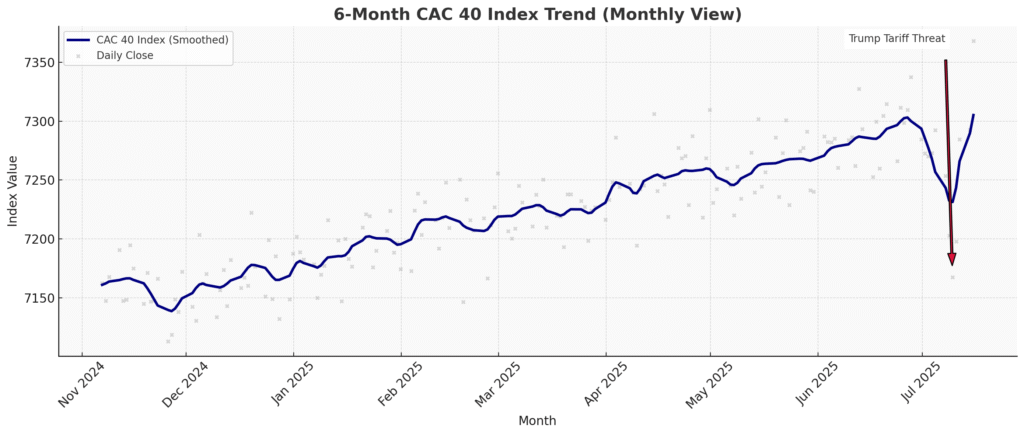

European financial markets opened cautiously on July 9, 2025, following fresh comments from former U.S. President Donald Trump regarding potential tariffs on key EU imports if re-elected. While the broader EU response remained muted, France emerged as the weak link amid ongoing political instability and fiscal uncertainty, causing its bonds and equities to underperform the region.

Trump’s latest proposal, announced late July 8 during a campaign rally in Ohio, includes the possibility of a 50 percent tariff on industrial metals and up to 200 percent on pharmaceutical exports from Europe. While markets have become used to Trump’s trade rhetoric, this time the reaction was more serious. Traders worry that a return to aggressive tariff policy could hit export-heavy economies hard, especially as global growth projections weaken into Q3 2025.

Germany and the Netherlands reacted with typical resilience, while the STOXX 600 index remained flat in early trading. But France’s CAC 40 fell 0.8 percent by mid-day, as investors weighed the country’s political paralysis. Prime Minister François Bayrou has failed to pass key fiscal reforms, and the national deficit is expected to exceed forty billion euros by the end of the year. This environment makes France especially vulnerable to external shocks like tariffs or bond yield increases.

Bond markets reflected the tension. The spread between French OATs and German Bunds widened to 82 basis points on July 9, its highest level since 2022. Some analysts are warning that if France does not present a credible economic plan before the European Council summit in September, rating agencies may consider a downgrade.

Investor confidence in France is also being eroded by its diminishing influence in Brussels. During recent U.S.–EU trade talks in early July, France was notably absent from the core negotiation bloc, with sources inside the EU Commission citing political instability as the main reason. In contrast, Germany, Italy, and Spain were all involved in shaping key industrial policy proposals.

For European investors, the emerging consensus is that France may not recover investor trust until after its 2026 national elections. In the meantime, hedge funds are reallocating away from French assets and toward Scandinavian and Eastern European markets that show more stability.

Recap:

On July 9, 2025, Trump’s tariff warnings triggered modest volatility in EU markets. France, already facing political and fiscal troubles, underperformed its peers. The bond spread with Germany widened sharply, and analysts warn of rising downgrade risks.

Trade Smarter. Anywhere, Anytime

SponsoredLooking for a secure and easy way to manage your crypto? Gemini helps you buy, sell, and store digital assets in just a few taps – no stress, no hassle.

With powerful tools, live market tracking, and insured wallets, Gemini gives you peace of mind while keeping you in control of your portfolio – whether you’re new to crypto or a seasoned trader.

Get started for free and make smarter trades with Gemini today.