Now Reading: Bank of America Signals Entry into Stablecoin Space

-

01

Bank of America Signals Entry into Stablecoin Space

Bank of America Signals Entry into Stablecoin Space

In a development that may redefine the line between legacy banking and digital assets, Bank of America CEO Brian Moynihan confirmed on July 16, 2025, that the bank is actively developing its own U.S. dollar-backed stablecoin.

The confirmation signals a decisive evolution in the bank’s crypto strategy, aligning it with both private-sector momentum and potential regulatory frameworks now emerging in Washington. According to a Reuters report, the institution has spent several months researching stablecoin infrastructure and customer use cases behind closed doors.

While technical specifics have not yet been disclosed, the stablecoin is expected to maintain a 1:1 peg with the U.S. dollar and could be applied across instant payment rails, cross-border transfers, and even decentralized finance (DeFi) integrations.

Bank of America is not alone in this shift. Morgan Stanley, Citigroup, and JPMorgan Chase are all reportedly exploring their own blockchain-backed asset strategies. Citi CEO Jane Fraser has previously confirmed that tokenized financial services are a strategic priority. Jamie Dimon, once skeptical of crypto, has recently acknowledged internal pilots focused on blockchain-based stable asset transfers at JPMorgan.

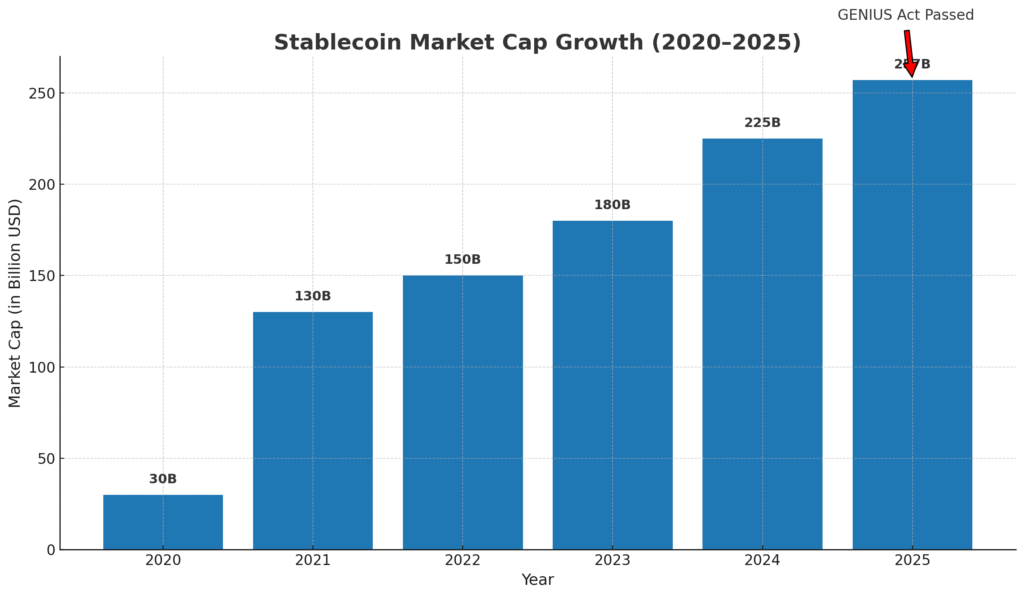

This institutional momentum is emerging just as lawmakers in the U.S. begin to coalesce around a clearer regulatory path. With bills like the GENIUS Act gaining traction, banks now appear more confident in engaging with blockchain technology under a defined legal structure.

For everyday users, these developments could mean more accessible and cost-effective financial tools. Stablecoins from well-established banks may also serve as an on-ramp to the broader crypto ecosystem, helping to bridge the gap between traditional finance and next-generation digital platforms.

Recap:

On July 16, Bank of America confirmed it is building a U.S.-backed stablecoin. Morgan Stanley, Citi, and JPMorgan are also pursuing similar efforts. Together, these moves represent a significant leap toward full-scale integration of blockchain into the core operations of mainstream banking.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.