Now Reading: Global Stocks and Crypto Rally as U.S. and Japan Seal Trade Deal

-

01

Global Stocks and Crypto Rally as U.S. and Japan Seal Trade Deal

Global Stocks and Crypto Rally as U.S. and Japan Seal Trade Deal

Global financial markets rallied on Wednesday after the United States and Japan concluded a trade agreement aimed at reducing tariffs and improving access across key industrial sectors.

The agreement lowers tariffs on automobiles, semiconductors, and technology exports. The most significant revision was the reduction of auto tariffs from 25 percent to 15 percent. This move helped ease investor concerns that have persisted since early 2024.

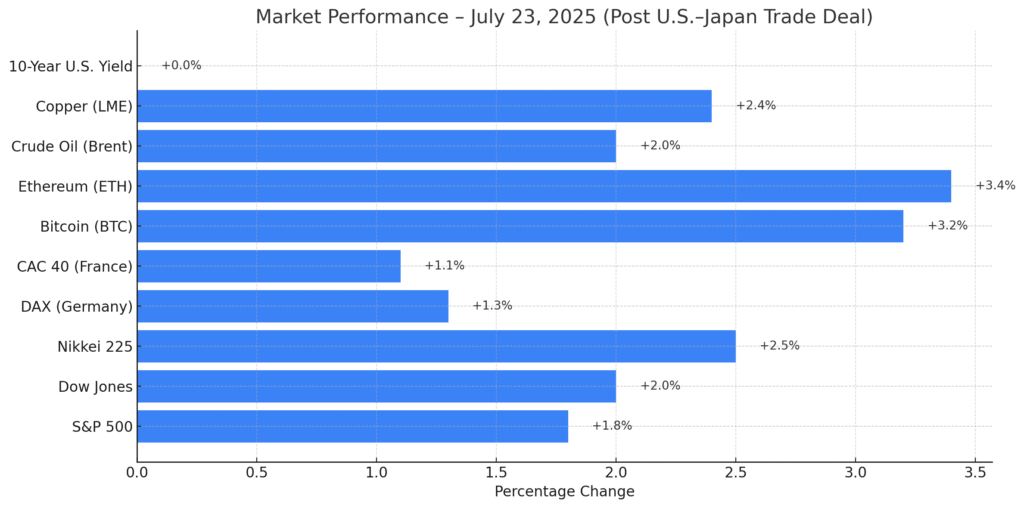

The S&P 500 rose 1.8 percent. The Dow Jones Industrial Average gained 2 percent. In Tokyo, the Nikkei 225 increased by nearly 2.5 percent, reflecting improved sentiment around Japanese exports. European stocks also advanced, with Germany’s DAX up 1.3 percent and France’s CAC 40 rising 1.1 percent. The MSCI All Country World Index reached a new quarterly high.

Bond markets were steady. The U.S. 10-year Treasury yield held at 4.12 percent after a $13 billion auction of 20-year bonds received strong demand from both domestic and foreign buyers. Analysts noted that the stable yield reflected investor confidence in the broader economic outlook and central bank policy.

In currency markets, the Japanese yen strengthened by 0.6 percent against the dollar. Investors interpreted this as a sign of confidence in Japan’s trade recovery. Commodities also gained. Brent crude rose 1.9 percent to $86.20 per barrel. Copper climbed 2.4 percent amid rising expectations for global industrial demand.

Cryptocurrency prices followed the rally. Bitcoin rose 3.2 percent to $118,300, while Ethereum approached $3,200. Blockchain assets linked to AI and infrastructure projects, such as Render and Fetch.ai, also saw modest gains.

Figure: Market Index Growth in the lead-up to the U.S.–Japan Trade Deal (July 2025)

The political impact of the trade deal could be significant. U.S. President Joe Biden is expected to present the agreement as a pro-trade achievement ahead of the election. Japanese Prime Minister Fumio Kishida, who faces domestic challenges, may benefit from renewed economic momentum.

Technology and automotive stocks led gains. Nvidia rose 3.4 percent, while Taiwan’s TSMC added 2.9 percent. Ford and General Motors gained more than 2 percent each. Analysts expect that reduced tariffs will support global production and strengthen supply chains.

Some observers believe this deal could lead to further talks between the U.S. and other regional economies such as South Korea. While no timelines have been announced, diplomatic engagement between trade partners appears to be improving.

Investors are now watching for corporate earnings and central bank announcements in early August. If inflation stays under control and supply chain stability continues, this rally may carry into the third quarter.

Recap: On July 23, the United States and Japan finalized a major trade agreement that lowered tariffs and boosted investor confidence. Stocks climbed globally, bond markets stayed calm, and crypto assets gained. The deal is expected to benefit manufacturing, trade, and tech sector growth as markets move into the second half of 2025.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.