Now Reading: Goldman Sachs and BNY Mellon Tokenize Money Market Funds

-

01

Goldman Sachs and BNY Mellon Tokenize Money Market Funds

Goldman Sachs and BNY Mellon Tokenize Money Market Funds

Goldman Sachs and BNY Mellon announced a landmark initiative to tokenize shares of money market funds, signaling a growing shift in how traditional finance integrates blockchain infrastructure.

The initiative uses BNY Mellon’s LiquidityDirect platform and Goldman Sachs’ proprietary blockchain system to digitize fund shares, allowing for faster and more transparent settlement. Sources close to the project confirmed that major asset managers, including BlackRock, Fidelity, and Federated Hermes, have already expressed interest in participating.

Tokenization, in this context, enables fund shares to be issued as blockchain-based digital tokens that can be transferred and settled efficiently. While traditional settlement often takes up to 48 hours, digital tokens can be exchanged almost instantly, improving speed while reducing operational costs and risks.

For institutional investors managing large volumes of short-term assets, this development could offer streamlined collateral handling and audit transparency. It represents one of the most concrete efforts yet to move tokenized products into the mainstream of capital markets.

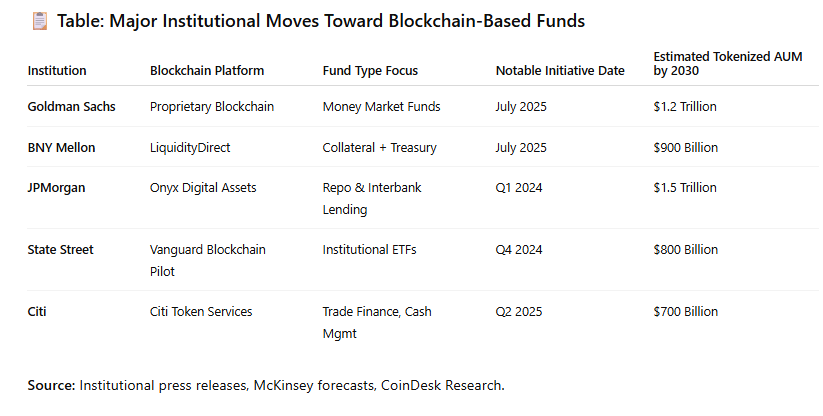

The move reflects a broader shift occurring across the banking sector. Over the past 18 months, institutions like JPMorgan, Citi, and State Street have launched or expanded blockchain-based services targeting settlement and fund flows. Analysts at McKinsey estimate that tokenization could capture up to $5 trillion in real-world assets by 2030, particularly in money markets, real estate, and bonds.

Despite optimism, some challenges persist. Regulatory clarity on asset custody, tax treatment, and cross-border enforcement remains incomplete. However, BNY Mellon emphasized that all tokenized fund shares will continue to comply with SEC and FINRA rules, with clients maintaining full access to reporting and audit trails.

Many observers see this as a “proof of concept” moment that could accelerate the institutional adoption of blockchain infrastructure. If early results show cost and speed advantages without undermining compliance, other custodians and fund managers may feel compelled to follow.

The tokenized money market product officially launched on July 23, with institutional onboarding expected to scale in the third quarter of 2025.

Recap:

Goldman Sachs and BNY Mellon have launched a blockchain-based initiative to tokenize money market fund shares. The project, which uses the LiquidityDirect platform and Goldman’s proprietary tech stack, aims to improve settlement speed, reduce operational costs, and introduce audit-friendly digital tokens for institutional clients. With backing from major asset managers and estimates pointing to $5 trillion in tokenized assets by 2030, the effort reflects a turning point in how traditional finance embraces digital infrastructure.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.