Now Reading: President Trump Signs Executive Order to Stop Debanking of the Bitcoin and Crypto Industry

-

01

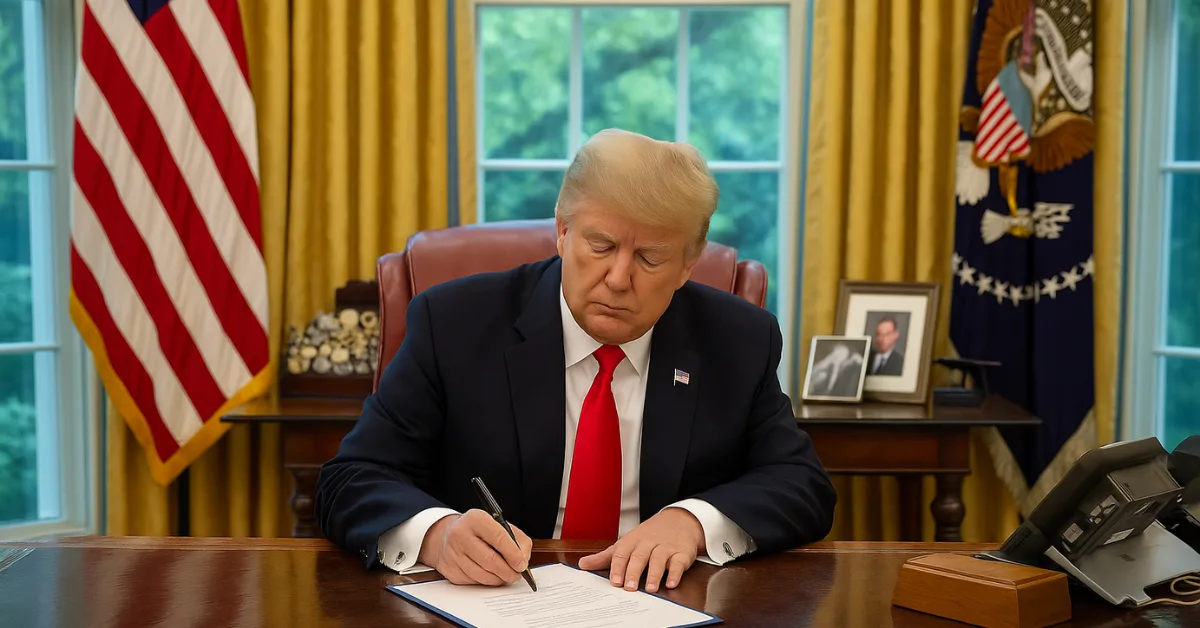

President Trump Signs Executive Order to Stop Debanking of the Bitcoin and Crypto Industry

President Trump Signs Executive Order to Stop Debanking of the Bitcoin and Crypto Industry

President Donald Trump has signed a sweeping executive order aimed at ending the practice of “debanking”, where banks and regulators restrict or deny services to individuals and businesses based on political or religious beliefs, or lawful participation in the cryptocurrency sector.

The measure, effective immediately, is being described by policy analysts as one of the most consequential developments in U.S. digital asset and financial inclusion policy, and many expect it to fundamentally alter how financial institutions engage with politically sensitive industries and emerging technology companies.

Key Provisions

Under the order, federal banking agencies including the Treasury Department, Federal Deposit Insurance Corporation (FDIC) and Office of the Comptroller of the Currency (OCC) must prohibit guidelines that allow politicized or discriminatory account closures.

“No American should be denied access to financial services because of their political or religious beliefs, or for legal business activities,” a White House fact sheet stated.

The directive requires:

- Regulatory Review – Federal agencies must audit banks for discriminatory practices and remove “reputational risk” standards often used to justify debanking.

- Enforcement Measures – Institutions found in violation will face penalties, with cases referred to the Justice Department for possible civil action.

- Client Reinstatement – The Small Business Administration will encourage banks to reinstate accounts previously closed under such policies.

Boost for Cryptocurrency and Digital Assets

The order is widely regarded as a breakthrough for the cryptocurrency industry, which has faced years of restrictive banking measures that advocates claim have hindered innovation, limited access to capital and weakened the United States’ ability to compete with international markets where digital assets have been embraced more aggressively.

It specifically addresses crypto-related debanking, a practice that surged in recent years amid heightened compliance concerns and perceived risk exposure for banks.

In a related move, Trump signed a companion order allowing 401(k) retirement plans to include digital assets, potentially opening the market to more than 90 million U.S. savers and channeling billions of dollars in new investment into the sector, a step industry leaders say could accelerate mainstream adoption.

Industry and Political Reaction

Trump, speaking to CNBC, connected the policy to his personal experience:

“The banks discriminated against me very badly. I’m not going to let them take advantage of you any longer.”

Major banking associations have cautiously welcomed the decision, stating that unclear regulatory frameworks and overly broad risk standards have long complicated their ability to serve certain clients, and that the creation of uniform national rules could reduce uncertainty for both banks and customers.

Digital asset executives called the order “a win for innovation and financial fairness”, predicting it will encourage institutional participation, foster new fintech startups and signal a more open approach to emerging markets.

Recap :

Analysts believe the order could:

- Increase transparency and accountability in the banking system.

- Expand access to services for politically sensitive and technology-driven businesses.

- Prompt updates to anti-money-laundering and compliance frameworks.

- Accelerate Congressional action on open banking and digital asset legislation.

With the directive now in effect, regulators, banks and fintech companies are preparing for a significant shift in U.S. financial policy, and while supporters believe it will foster competition and inclusion, critics caution that its implementation will require careful oversight to prevent unintended consequences in the broader economy.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.