Now Reading: 82% of S&P 500 Companies Beat Quarterly Earnings Estimates Despite Trump Tariffs

-

01

82% of S&P 500 Companies Beat Quarterly Earnings Estimates Despite Trump Tariffs

82% of S&P 500 Companies Beat Quarterly Earnings Estimates Despite Trump Tariffs

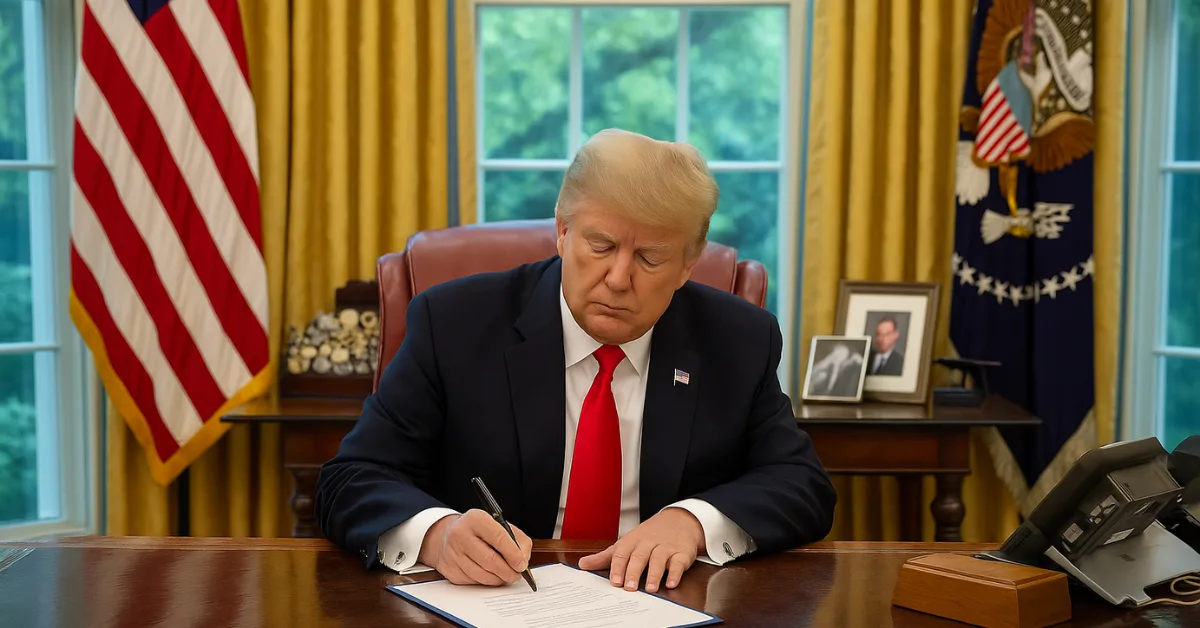

A remarkable 82% of S&P 500 companies have reported quarterly earnings that exceeded Wall Street expectations, underscoring the resilience of corporate America in the face of new tariff measures introduced by President Donald Trump.

The latest earnings season, which has now seen reports from more than 400 index constituents, indicates that companies have largely managed to navigate higher input costs and global trade uncertainty. Analysts point to strong domestic demand, improved productivity, and robust technology sector growth as the main drivers of the better-than-expected performance.

President Trump’s tariffs, aimed at boosting domestic manufacturing and reducing reliance on imports, were widely expected to weigh on profit margins. However, a majority of firms appear to have offset the impact through cost-cutting, supply chain diversification, and in some cases, strategic price adjustments that passed part of the additional costs to consumers.

“This is one of the strongest beats relative to expectations we have seen in the past decade, particularly during a policy environment that has been challenging for multinationals,” said Sarah Whitfield, chief market strategist at Broadline Capital.

Technology and financial services led the gains, with 89% and 85% of companies in those sectors, respectively, surpassing earnings estimates. Energy and consumer staples also showed unexpected strength, driven by higher commodity prices and sustained consumer spending. In contrast, the industrial sector reported more modest beats, reflecting ongoing supply chain adjustments.

U.S. equity markets reacted positively, with the S&P 500 index gaining 1.3% in afternoon trading and setting a fresh intraday high. Investors are now weighing whether the momentum can continue into the next quarter, especially if tariffs remain in place and global demand shows signs of slowing.

“Corporate America has once again shown its adaptability,” noted Jonathan Hayes, senior portfolio manager at CrestPoint Advisors. “The challenge will be maintaining this earnings growth as the tariff impact accumulates over time and other macroeconomic factors evolve.”

The earnings results have strengthened expectations for sustained stock market performance into the second half of the year, although analysts caution that geopolitical developments, monetary policy shifts, and currency volatility could introduce new risks.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.