Now Reading: XLM Under Pressure: Price Crashes Through Support, Volume Soars

-

01

XLM Under Pressure: Price Crashes Through Support, Volume Soars

XLM Under Pressure: Price Crashes Through Support, Volume Soars

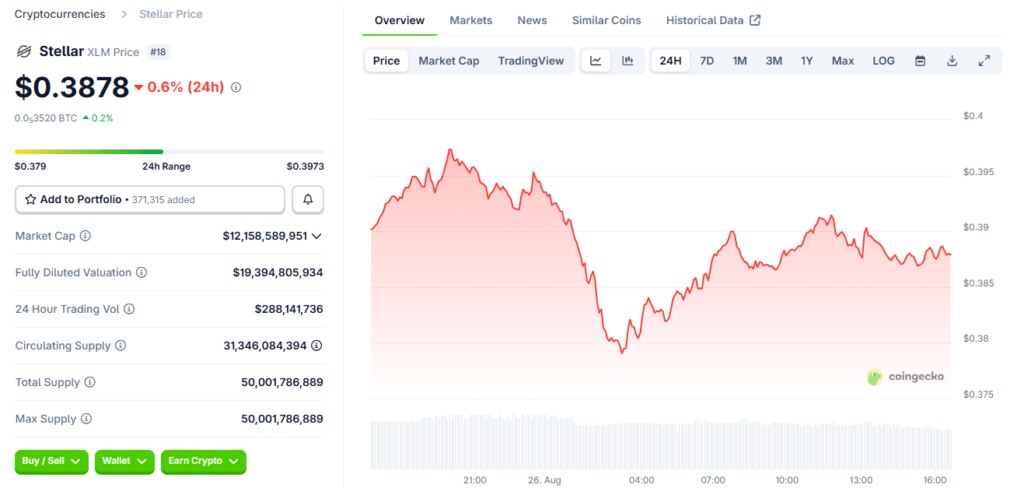

Stellar’s native token XLM fell sharply below a key support level on Tuesday as trading activity surged, underscoring mounting volatility across mid-cap cryptocurrencies.

The token dropped to around $0.086 by early afternoon, down nearly 9% over the past 24 hours. This marked a decisive break below the $0.09 support zone that had held for over two weeks. Trading volume nearly doubled during the same period, reaching roughly $480 million compared to $245 million a day earlier, according to CoinMarketCap data.

Analysts say the price slide reflects both macroeconomic pressures and technical selling. “The recent breach of support suggests momentum traders are exiting positions amid broader market uncertainty,” said Elena Kovacs, head of digital assets strategy at Geneva Capital. “XLM’s on-chain activity has remained stable, but investor sentiment is fragile, particularly after Bitcoin’s sharp swings this month.”

The Stellar network underpins cross-border payment infrastructure and remittance services, and its token has historically traded in tandem with risk appetite for altcoins. However, sustained weakness in the sector is weighing on prices. “Volume spikes of this magnitude often accompany trend reversals,” noted Raj Malhotra, a market strategist at Blockwave Research. “If XLM fails to reclaim the $0.09 level soon, the next major support could lie near $0.078.”

Broader market conditions have also contributed to the downturn. Bitcoin was recently trading near $113,500, off about 0.8% on the day, while Ethereum dipped 1.2% to around $3,950. The overall cryptocurrency market capitalization stood at approximately $2.38 trillion, reflecting subdued risk sentiment ahead of key U.S. economic data later this week.

Despite the selloff, some see potential opportunities. Analysts point to Stellar’s ongoing partnerships with fintech firms and its role in developing blockchain-based settlement networks as longer-term catalysts. Still, caution prevails in the near term. Technical traders are watching whether XLM’s volume surge leads to a short-term capitulation or deeper correction.

Market participants remain alert for macro signals and regulatory headlines that could sway sentiment. While the doubled trading activity indicates heightened interest, sustained price recovery may depend on broader crypto market stability and renewed institutional inflows.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.