Now Reading: Ethereum Whale Transfer: $293 Million Moved by FalconX Sparks Industry Buzz

-

01

Ethereum Whale Transfer: $293 Million Moved by FalconX Sparks Industry Buzz

Ethereum Whale Transfer: $293 Million Moved by FalconX Sparks Industry Buzz

FalconX carried out a massive Ethereum transfer worth $293 million, sparking discussion among analysts and traders. The move highlights the influence of institutional liquidity providers and raises questions about how large-scale transfers affect market stability across exchanges, including those competing to be recognized as the best crypto exchange platforms.

The Whale Transfer

Blockchain data from Etherscan showed FalconX shifted 450,000 ETH from one wallet to an exchange-linked address late Wednesday. FalconX confirmed the transfer as part of routine treasury management. In addition, sources said the Ethereum went to a mix of custody providers and liquidity pools.

The size of the transaction quickly attracted traders who monitor whale movements for signs of volatility. However, large transfers do not always lead to selling. They often generate speculation about the strategies behind institutional flows.

Context and Significance

As of Thursday, Ethereum held a market capitalization of about $380 billion, keeping its position as the second-largest cryptocurrency. The asset traded in a tight range between $2,950 and $3,250 for the past month. FalconX’s move came at a moment when institutional flows faced heightened scrutiny. As a result, exchanges are competing for high-volume clients and aiming to position themselves among the best crypto exchange options for professional investors.

“Whale transfers like this show how far the industry has matured,” said Lina Chen, senior strategist at Matrixport. “Institutions now move hundreds of millions in one shot, and they rely on infrastructure that only a few exchanges and custodians can provide.”

Expert Commentary

Analysts disagree on the impact. Some see a bullish sign, suggesting liquidity is entering structured products. In contrast, others warn that the move could precede selling pressure.

“FalconX trades in both over-the-counter and exchange markets, so such transfers are common,” said David Ross, a crypto markets advisor at Block Insights. “Still, traders should watch closely. If large volumes hit order books, even the best crypto exchange platforms will feel pressure on spreads and liquidity depth.”

Regulators are also watching closely. “These transfers reveal the scale of institutional crypto activity,” said a former U.S. Commodity Futures Trading Commission official. “Traditional risk frameworks are not designed for the speed and size of digital asset movements. Therefore, monitoring whale flows is becoming as critical as tracking derivatives activity in traditional markets.”

Market Impact

After the transfer, Ethereum lost 1.2% to $3,010 before rebounding to $3,080 within hours. Meanwhile, trading volumes climbed across Coinbase, Binance, and Kraken, each reporting increases of more than 15% compared to the day before.

At press time, Ethereum had gained 0.8% in 24 hours, while weekly performance stayed flat. CoinMarketCap reported total daily trading volume at $18.4 billion. Analysts noted that the rebound showed markets absorbed the liquidity effectively, reinforcing the role of leading exchanges in maintaining stable conditions.

Outlook and Risks

The FalconX transaction highlights the growing connection between institutional finance and digital assets. For investors, the key lesson is that large transfers may not destabilize markets, but they underline the scale of capital flowing through crypto.

For exchanges, the challenge is clear. They must deliver liquidity and security for institutions while also meeting the needs of retail traders. Consequently, platforms that combine compliance, deep liquidity, and innovative services stand the best chance of being regarded as the best crypto exchange.

Risks remain. Volatility, regulatory shifts, and whale concentration could test resilience. Still, analysts argue that the next stage of growth depends on whether exchanges can balance institutional demands with retail adoption.

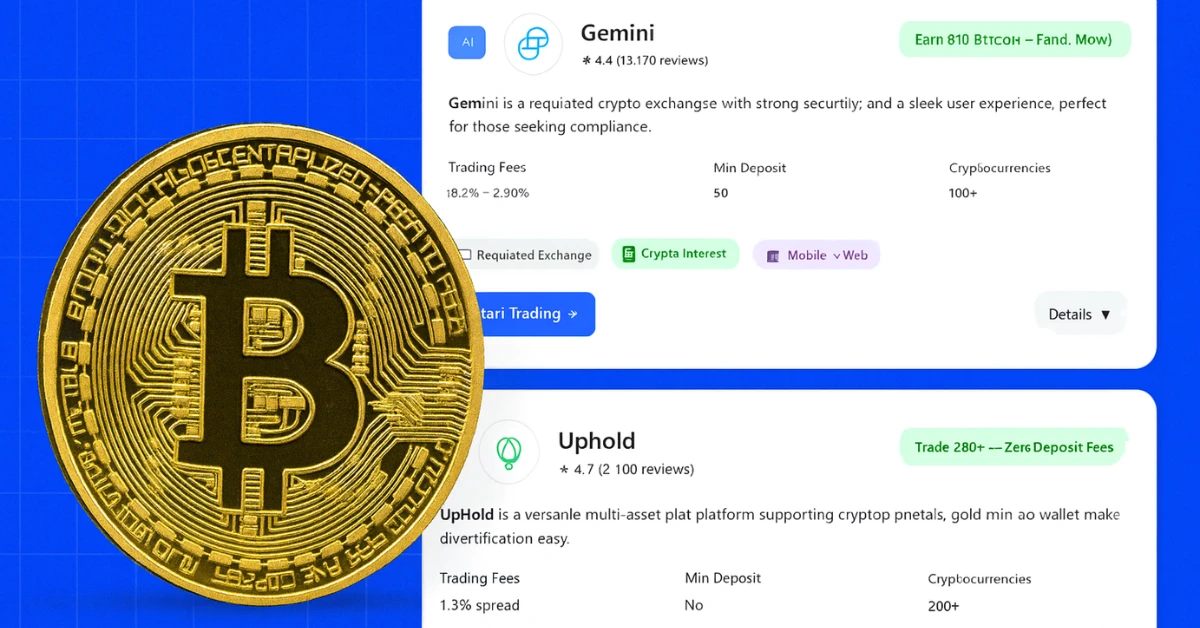

FalconX’s transfer illustrates how billions can shift in minutes. Exchanges that adapt and absorb such flows will define the competition to be recognized as the best crypto exchange. See our Gemini review for insights on exchange security.

Gemini Trade. Secure Crypto on the Go.

SponsoredLooking for a secure and easy way to manage your crypto? Gemini helps you buy, sell, and store digital assets in just a few taps – no stress, no hassle.

With powerful tools, live market tracking, and insured wallets, Gemini gives you peace of mind while keeping you in control of your portfolio – whether you’re new to crypto or a seasoned trader.

Get started for free and make smarter trades with Gemini today.