Now Reading: Bitcoin Holds Firm Near $117K Post-Fed Rate Cut; Zeta Token Rockets 73% in 24 Hours

-

01

Bitcoin Holds Firm Near $117K Post-Fed Rate Cut; Zeta Token Rockets 73% in 24 Hours

Bitcoin Holds Firm Near $117K Post-Fed Rate Cut; Zeta Token Rockets 73% in 24 Hours

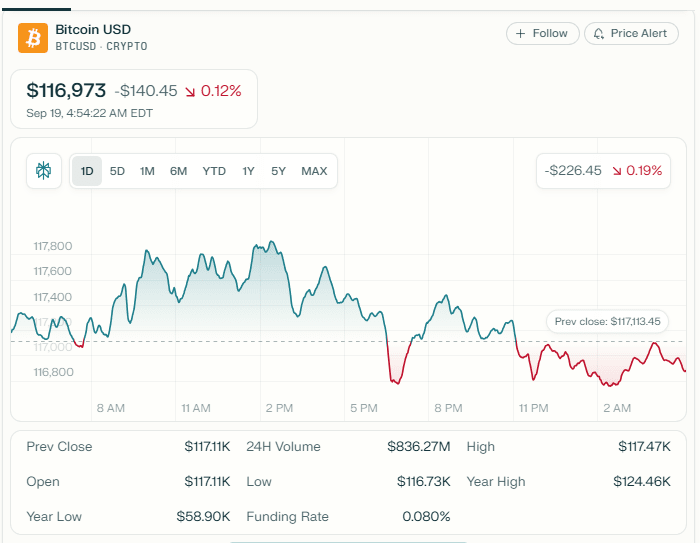

Bitcoin price near $117K after Fed rate cut held steady on Thursday, showing resilience after the U.S. Federal Reserve delivered its first interest rate cut in more than four years. Meanwhile, Zeta Token (ZETA), a mid-cap altcoin, surged 73% in the past 24 hours, underscoring investor appetite for high-risk digital assets amid easing monetary conditions.

Bitcoin Price Steadies After Fed Rate Cut

The Federal Reserve announced a 25-basis-point cut late Wednesday, lowering its benchmark rate to a range of 4.75%–5.00%. The move ended a prolonged tightening cycle that had weighed on risk assets throughout 2022 and 2023. Bitcoin, often described as a “digital macro asset,” reacted with measured strength rather than speculative frenzy. Prices hovered between $116,200 and $117,800 through Asian and European trading sessions.

“Markets had largely priced in the cut, but Bitcoin’s stability above $115,000 shows a strong floor of institutional demand,” said Priya Menon, senior digital asset strategist at GlobalBlock Advisors. “Traders are positioning for a medium-term rally if further cuts follow in 2025.”

Spot market volume for Bitcoin reached $42.5 billion over 24 hours, up 18% from earlier in the week. Derivatives markets also reflected calm, with open interest on Chicago Mercantile Exchange Bitcoin futures rising 5% to $14.3 billion.

Zeta Token Price Jumps 73% in 24 Hours

Zeta Token, a decentralized finance asset tied to cross-chain liquidity networks, surged sharply to $8.14 from $4.70 in a single day. The token’s market capitalization climbed above $9.5 billion, briefly placing it within the top 25 global digital assets. Daily trading volume spiked to $1.7 billion, its highest since launch in mid-2023.

“Zeta’s breakout highlights the renewed speculative energy in altcoins whenever macro policy tilts supportive,” explained David Kang, portfolio manager at Horizon Digital Capital. “Liquidity conditions matter, and rate cuts tend to drive capital into higher-beta segments of crypto first.”

Market participants attributed part of the rally to Zeta’s new staking rewards program, which promises annualized yields up to 18% for liquidity providers. Analysts cautioned, however, that rapid gains leave the token vulnerable to sharp pullbacks.

Crypto Market Reaction to Fed Policy Shift

The Fed’s policy shift came as U.S. inflation slowed to 2.4% year-on-year, its lowest level since 2021. At the same time, signs of softening labor demand and consumer spending prompted policymakers to prioritize growth support. Equities rallied modestly, with the S&P 500 up 0.7% on Wednesday, while gold edged higher to $2,470 per ounce.

Bitcoin’s performance contrasted with earlier tightening cycles. In 2022, aggressive Fed hikes pushed the cryptocurrency below $20,000, sparking one of its deepest bear markets. The current backdrop appears more constructive, with institutional participation at record levels through crypto ETFs.

Data from BlackRock’s iShares Bitcoin Trust showed net inflows of $240 million on Wednesday, bringing its total assets under management to $32.4 billion. Industry observers said such flows reinforce Bitcoin’s reputation as a macro hedge rather than merely a speculative instrument. For retail investors exploring regulated platforms, resources such as Financyze’s guide to the best crypto platforms of 2025 highlight available trading options.

Analysts Weigh Bitcoin Outlook After Rate Cut

Analysts remain divided on how far the Fed will cut in the coming quarters. Some see room for gradual reductions if inflation stays contained, while others warn of premature easing.

“If the Fed signals another cut by December, Bitcoin could test $125,000 quickly,” noted Kang of Horizon Digital. “But if inflation re-accelerates, volatility will return fast and hard.”

Regulators also continue to monitor speculative excess. A senior official at the U.S. Commodity Futures Trading Commission, speaking on background, said the agency was “closely tracking leverage buildup in crypto derivatives markets,” particularly after the sharp rise in open interest this week.

Risks and Opportunities for Crypto Investors

While Bitcoin’s stability suggests growing maturity, risks remain. Renewed inflation pressure could force the Fed to reverse course. In addition, concentrated flows into mid-cap tokens like Zeta often precede market corrections when retail enthusiasm peaks.

“History shows altcoin rallies can unravel quickly,” Menon of GlobalBlock said. “Investors should focus on liquidity depth and real adoption metrics, not just 24-hour price spikes.”

At the same time, supporters argue that the combination of monetary easing, institutional ETF inflows, and steady network fundamentals sets Bitcoin apart from past cycles. Active addresses and transaction volumes remain elevated, signaling healthy usage beyond trading speculation.

Bitcoin and Altcoin Market Outlook

The crypto market enters autumn with a mixed but constructive backdrop. Bitcoin’s ability to hold near $117,000 after a landmark Fed cut underscores its resilience as an asset class increasingly tied to macroeconomic shifts. Altcoins, led by Zeta’s dramatic rally, illustrate both the opportunity and risk that easing liquidity injects into the digital economy.

With policymakers signaling data-driven adjustments and investors showing renewed appetite for digital assets, the coming weeks will test whether crypto can sustain momentum without overheating. For now, Bitcoin’s quiet strength and Zeta’s bold surge capture the twin narratives shaping markets: institutional maturity on one side, and speculative vigor on the other.

Gemini Trade. Secure Crypto on the Go.

SponsoredLooking for a secure and easy way to manage your crypto? Gemini helps you buy, sell, and store digital assets in just a few taps – no stress, no hassle.

With powerful tools, live market tracking, and insured wallets, Gemini gives you peace of mind while keeping you in control of your portfolio – whether you’re new to crypto or a seasoned trader.

Get started for free and make smarter trades with Gemini today.