Now Reading: Decentralized AI Tokens Ignite New Wave of Crypto Innovation

-

01

Decentralized AI Tokens Ignite New Wave of Crypto Innovation

Decentralized AI Tokens Ignite New Wave of Crypto Innovation

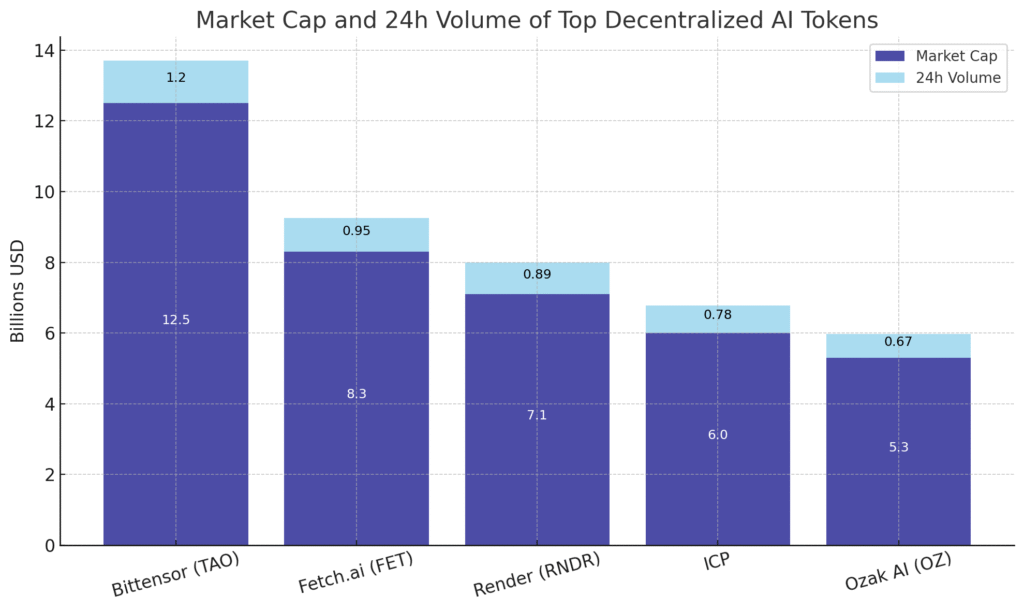

A new class of decentralized artificial intelligence tokens is gaining momentum as blockchain projects transition from speculative hype to functional infrastructure. Tokens such as Bittensor (TAO), Fetch.ai (FET), Render (RNDR), Internet Computer (ICP), and Ozak AI (OZ) are capturing attention due to their utility in powering distributed AI networks and enabling collaborative machine intelligence.

These assets facilitate core AI capabilities, including model training, GPU-based rendering, and intelligent data management, within open and incentivized blockchain ecosystems. Participants contribute computing power, data models, or autonomous agents and receive token-based compensation. The sector reflects crypto’s broader evolution toward programmable utility, moving beyond meme coins and nonfunctional tokens.

Flagship Projects Gain Momentum

Among the most prominent platforms is Bittensor, a decentralized machine learning protocol that rewards users for contributing computational resources to train AI models. The project’s limited token issuance, active developer base, and real-time functionality have attracted significant long-term interest.

Fetch.ai is building a network of autonomous economic agents designed to facilitate decentralized decision-making, logistics optimization, and dynamic data exchange. It is also one of the leading members of the Artificial Superintelligence Alliance (ASI), a governance initiative jointly proposed with SingularityNET and Ocean Protocol to unify AI-focused blockchain efforts under a single token.

Render Network (RNDR) enables decentralized access to GPU power for 3D visual processing and AI task execution. With the expansion of generative AI, Render offers developers a cost-efficient alternative to centralized cloud providers.

Internet Computer (ICP) delivers scalable, on-chain computing infrastructure that enables developers to create and deploy AI-enhanced decentralized applications directly on the blockchain. Ozak AI (OZ), an emerging entrant, is exploring predictive intelligence solutions across finance, logistics, and enterprise analytics.

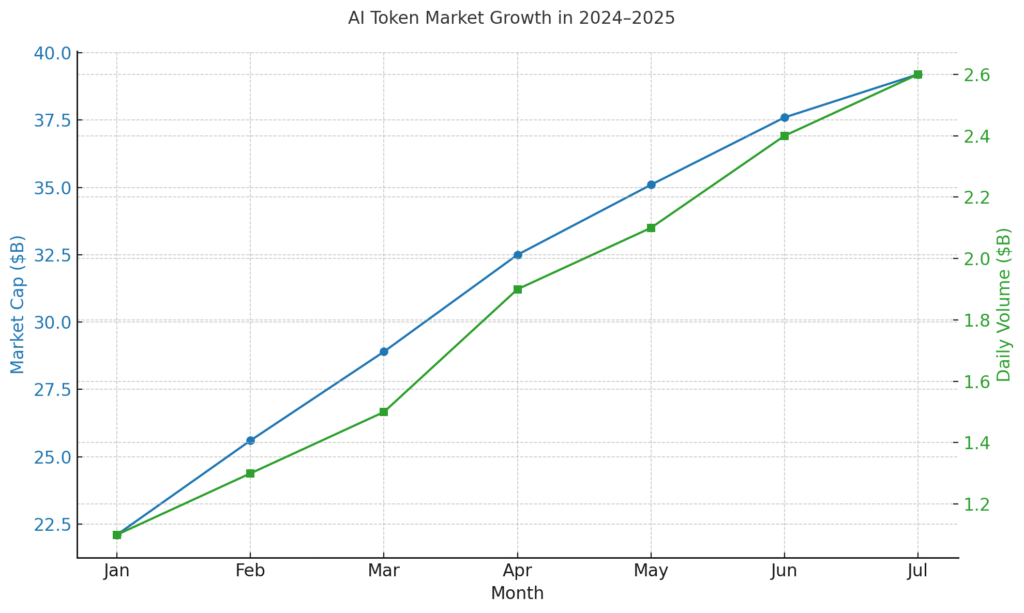

$39.2 Billion AI Token Market Signals Investor Shift

According to analytics firm Bittime, the collective market capitalization of AI-focused tokens surpassed $39.2 billion in early 2024, with 24-hour volumes nearing $2.6 billion. These figures underscore the sector’s expanding liquidity and adoption across institutional and retail segments.

Investor enthusiasm is driven by increasing network utility and maturing economic models. Token holders now benefit from functional platforms offering real-world services, such as automated data collection, task outsourcing, and permissionless computing power.

Regulatory Certainty Encourages Institutional Participation

The GENIUS Act, passed in early 2025, provides a regulatory framework for AI-token projects in the United States. Alongside the proposed CLARITY Act, the legislation clarifies how tokens can be classified and disclosed. This has made it easier for traditional financial institutions to enter the space.

According to Reuters, tokenized real-world assets such as real estate, private equity, and funds are expected to grow from $256 billion today to nearly $2 trillion by 2028. AI tokens are now recognized as a vital sub-sector within this broader transformation.

Real-World Applications Fuel Adoption

Decentralized AI tokens are already being used across multiple functional areas:

- Model training incentives: Projects like Bittensor and Fetch.ai reward users who train or validate machine learning models.

- GPU resource sharing: Render distributes idle GPU capacity for compute-heavy applications, reducing reliance on major cloud providers.

- Autonomous agents: Fetch.ai enables smart agents to collect data, perform API calls, and execute trades.

- On-chain execution: ICP supports AI-enabled applications entirely within a decentralized environment.

Risks Remain Despite Progress

Although the AI token market is expanding, it remains relatively early in its development. Market capitalization is still small compared to top cryptocurrencies, and technical complexity adds another layer of risk.

Volatility remains a concern. Token prices can shift rapidly due to market sentiment or speculative trading. Regulatory uncertainty is also present, especially in areas involving data privacy, model ownership, and international compliance. Execution risk is material. The success of each project depends on usage metrics, developer engagement, and actual delivery of promised technology.

Key Developments to Watch in 2025

- ASI Token Launch: Fetch.ai, SingularityNET, and Ocean Protocol are expected to introduce a unified governance token under the ASI alliance.

- Institutional Adoption: Asset managers, venture capital firms, and infrastructure funds may begin investing in decentralized AI networks.

- Network Performance Metrics: Indicators such as GPU utilization, model output volume, and on-chain participation will be critical for tracking project value.

Recap

Decentralized AI tokens are surging as a new frontier in crypto, blending programmable blockchain networks with global AI resource sharing. Key projects like Bittensor, Fetch.ai, Render, ICP, and Ozak are building real-world infrastructure and attracting major market attention. While risks remain, institutional trends and token innovation suggest this trend could define the next phase of crypto growth.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.