Now Reading: Justin Sun’s USDD Launches on Ethereum, Targeting Tether’s $169 Billion Dominance

-

01

Justin Sun’s USDD Launches on Ethereum, Targeting Tether’s $169 Billion Dominance

Justin Sun’s USDD Launches on Ethereum, Targeting Tether’s $169 Billion Dominance

Crypto entrepreneur Justin Sun has officially launched his USDD stablecoin on the Ethereum network, a strategic move that puts the asset in direct competition with Tether (USDT), the world’s largest stablecoin. Tether currently dominates the market with more than $169 billion in circulation, leaving USDD with a steep climb as it seeks broader adoption.

A Strategic Shift to Ethereum

USDD went live on Ethereum on Sept. 8, marking its expansion beyond Sun’s TRON blockchain, where it had primarily operated since its inception. By shifting to Ethereum, the stablecoin gains entry into the world’s largest decentralized finance (DeFi) ecosystem, which boasts deeper liquidity, broader integration, and a more diverse user base than TRON.

Stablecoins remain critical to crypto markets because they serve as fiat-backed bridges, facilitating trading, lending, and payments. Currently, Tether accounts for more than 60% of the $251 billion global stablecoin market. By contrast, USDD controls just $460 million in value, highlighting the scale of its challenge.

Liquidity Tools and Incentives

To enhance competitiveness, Sun’s team introduced a Peg Stability Module (PSM) on Ethereum. The mechanism enables users to instantly swap USDD with USDT or USDC, thereby reducing friction and potentially boosting adoption. In addition, the launch rolled out attractive incentives, offering early users annual yields of up to 12%. These rewards are designed to taper over time, encouraging swift participation while avoiding unsustainable long-term payouts.

USDD differs structurally from its rivals because it is overcollateralized and backed mainly by TRX and other crypto assets. However, the stability model has drawn scrutiny. Last year, Sun withdrew Bitcoin reserves, making the system more dependent on TRON ecosystem tokens and raising questions about diversification.

Expert Commentary: Cautious Optimism

Despite the new tools, experts remain skeptical about USDD’s ability to challenge Tether’s entrenched dominance.

“USDD’s liquidity and adoption must scale dramatically to become a real threat to USDT,” said digital asset strategist Priya Mehta. “Nonetheless, the Peg Stability Module is a smart step that improves conversion options and could build trust among traders.”

Regulator Paul Jensen offered a similar perspective. “Tether has entrenched exchange listings and global integrations, yet regulatory scrutiny continues to intensify. Therefore, newer entrants that prioritize compliance and transparency may eventually carve out market share, though it will not happen quickly.”

Growing Competition in Stablecoins

The field is not limited to USDD versus Tether. For instance, USDC, DAI, and PayPal’s PYUSD have all expanded rapidly in the past year. Meanwhile, Circle’s euro-denominated EURC has seen a sharp month-over-month rise in adoption, signaling demand for stablecoins beyond the U.S. dollar.

This diversification suggests that network effects, reserve transparency, and regulatory positioning will be decisive factors in determining long-term winners. Analysts note that stablecoins backed by traditional treasuries, such as Tether and USDC, are often viewed as safer compared to crypto-backed models like USDD.

Market Performance and Ethereum Advantage

Since its debut on Ethereum, USDD has managed to remain close to its $1 peg. Nevertheless, its market capitalization remains below $500 million. Tether, by comparison, processes over $50 billion in daily trading volume and more than $1 trillion globally each month.

Ethereum’s position as the hub of DeFi may work in USDD’s favor. As a result, yield-seeking traders and DeFi protocols could integrate the token to capitalize on incentives. Still, TRON continues to outperform Ethereum for small-scale transfers, primarily due to lower fees and faster processing times.

Looking forward, analysts expect the global stablecoin market to reach $2 trillion by 2030. Consequently, USDD’s expansion strategy could help it capture part of this growth, but questions around collateral composition and trust will remain central.

Beyond Ethereum: A Multi-Chain Push

USDD’s Ethereum launch is not an isolated step. Moreover, the stablecoin is already live on BNB Smart Chain, Avalanche, and Polygon, underscoring Sun’s ambition to build a multi-chain ecosystem. Soon, his team plans to introduce sUSDD, a yield-bearing version of the stablecoin designed to attract long-term holders by offering additional income opportunities.

The Road Ahead

Despite its aggressive expansion, USDD faces an uphill battle in dislodging Tether’s dominance. On the one hand, Sun’s move to Ethereum strengthens USDD’s credibility and positions it within the most liquid crypto ecosystem. On the other hand, reliance on TRON-based assets and the absence of fiat-backed reserves leave the project vulnerable to skepticism.

Still, analysts agree that competition among stablecoins could drive innovation. Therefore, USDD’s efforts to expand liquidity options, incentivize adoption, and explore yield-bearing versions may push the market toward greater diversity.

For now, the stablecoin war remains heavily tilted in Tether’s favor. However, Sun’s Ethereum gamble signals that smaller players are unwilling to concede ground and are prepared to experiment to win market share.

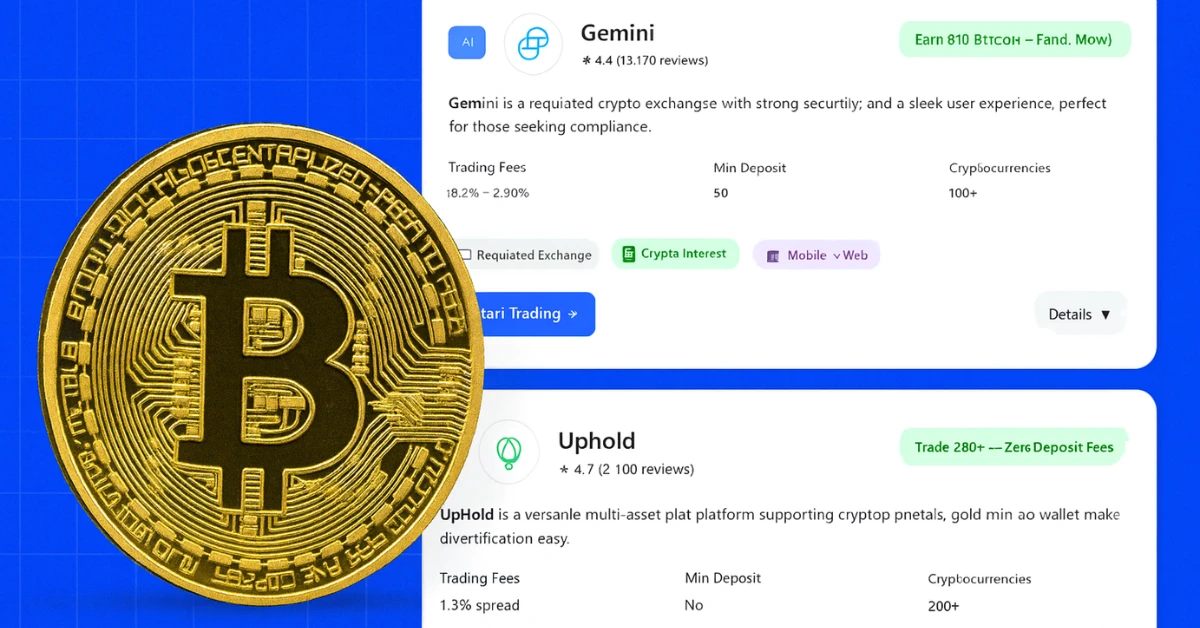

Gemini Trade. Secure Crypto on the Go.

SponsoredLooking for a secure and easy way to manage your crypto? Gemini helps you buy, sell, and store digital assets in just a few taps – no stress, no hassle.

With powerful tools, live market tracking, and insured wallets, Gemini gives you peace of mind while keeping you in control of your portfolio – whether you’re new to crypto or a seasoned trader.

Get started for free and make smarter trades with Gemini today.