Now Reading: France Loses Investor Confidence as Political Gridlock Threatens Its Economic Future

-

01

France Loses Investor Confidence as Political Gridlock Threatens Its Economic Future

France Loses Investor Confidence as Political Gridlock Threatens Its Economic Future

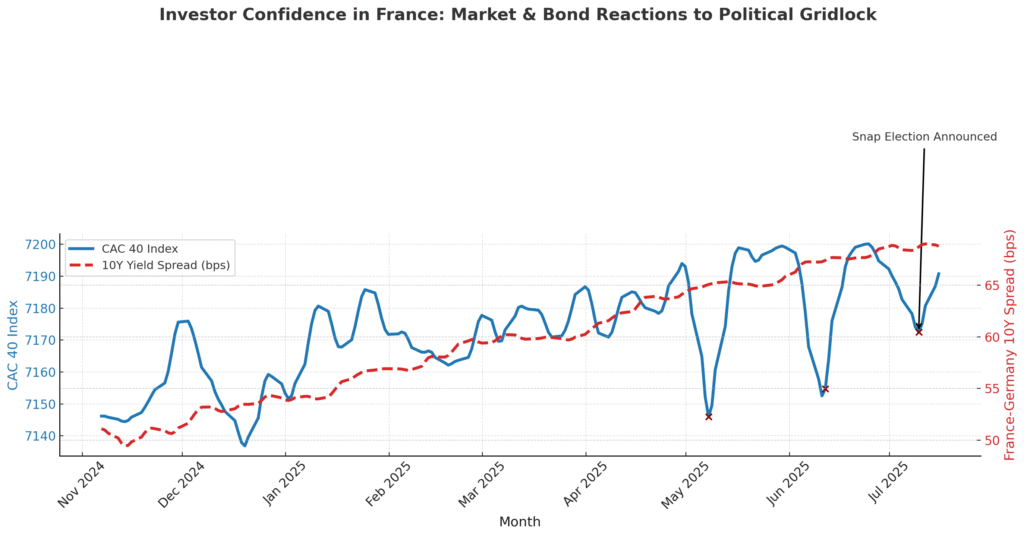

As of July 9, 2025, France is rapidly losing credibility among global investors due to ongoing political paralysis, a growing fiscal deficit, and declining market performance.

While European peers like Germany and Italy are securing trade deals and recovering from post-pandemic stagnation, France is slipping behind.

The national budget deficit is now projected to exceed forty billion euros by the end of 2025, and the government remains unable to pass the fiscal reforms needed to stabilize the economy.

Prime Minister François Bayrou and his centrist coalition have faced repeated legislative defeats throughout June and early July.

Proposals aimed at restructuring pension systems, cutting public sector spending, and reforming the national tax code have all stalled in the National Assembly.

As a result, the government has turned to temporary funding mechanisms that are being criticized by both the European Central Bank and credit rating agencies.

On the financial markets, the effects are already being felt.

As of July 9, the CAC 40 has returned just over five percent since January 2025, while Germany’s DAX index is up more than twenty percent over the same period.

Bond spreads between French OATs and German Bunds are at their widest since 2021.

Reports published by BNP Paribas and Société Générale on July 7 warned that without a comprehensive fiscal package in place by October, France could face a ratings downgrade from major agencies such as Moody’s or S&P.

France’s political instability is also hurting its standing in the European Union.

During EU-US trade discussions that concluded on July 5, France was excluded from the core negotiating group, signaling a clear loss of influence in Brussels.

Germany, by contrast, finalized deals related to green energy infrastructure and digital technology partnerships.

Italy and Spain also secured key investments, particularly in defense and AI research.

The domestic situation is worsening.

According to new data from INSEE published on July 8, youth unemployment rose to 21 percent in the southern regions.

Inflation remains stubbornly high at 4.7 percent year-on-year, despite government subsidies on fuel and electricity introduced in April.

Protests have resumed in cities like Marseille, Toulouse, and Lyon, not over politics but due to frustration with high living costs and a lack of government action.

International capital is already flowing elsewhere.

Hedge funds that previously invested heavily in French banks and infrastructure projects are now shifting toward Scandinavian and Central European markets.

On July 9, a London-based fund manager at Citadel confirmed in a Bloomberg interview that they were exiting French equities entirely due to political risk.

Unless the French government delivers a credible fiscal roadmap before the next EU summit in late September, the country may face more than just economic isolation.

The European Commission is reportedly considering new oversight mechanisms for member states that fail to meet fiscal targets, and France could be the first test case.

Recap:

On July 9, 2025, France faces mounting investor concern due to political deadlock and a growing fiscal crisis.

The CAC 40 lags behind European peers, bond spreads are widening, and government reforms remain blocked.

EU influence is waning as other countries move ahead.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.