Now Reading: JPMorgan Considers Crypto-Backed Loans for High-Net Clients

-

01

JPMorgan Considers Crypto-Backed Loans for High-Net Clients

JPMorgan Considers Crypto-Backed Loans for High-Net Clients

JPMorgan Chase revealed that it is actively exploring offering crypto-backed loans to its high-net-worth clients, according to a report by Reuters. This move signals a dramatic shift from the bank’s previously cautious approach to digital assets. If implemented, clients could use cryptocurrencies such as Bitcoin and Ethereum as collateral to secure credit lines or traditional loans—without liquidating their holdings.

JPMorgan has not yet announced a launch timeline, but insiders suggest the bank is already in talks with custodians to structure safe and compliant asset-holding frameworks. Unlike DeFi lending platforms, JPMorgan’s approach will likely prioritize regulatory alignment and borrower creditworthiness. It’s also notable that the bank will not handle crypto custody itself but partner with third parties with SEC-licensed infrastructure.

This development comes as traditional banks gradually warm up to digital assets under the pressure of client demand and evolving legal clarity. With the GENIUS Act and CLARITY framework gaining bipartisan traction in Washington, the environment for crypto-financial products has become less ambiguous. Banks are finally finding the policy room to innovate while minimizing compliance risks.

For clients, crypto-backed loans offer new financial flexibility. Rather than selling appreciated Bitcoin or Ethereum and incurring capital gains taxes, users can borrow against their assets to fund real estate, investments, or lifestyle purchases. This model is already common among crypto-native platforms like BlockFi or Ledn, but JPMorgan’s entry would bring it into the ultra-high-net-worth private banking space.

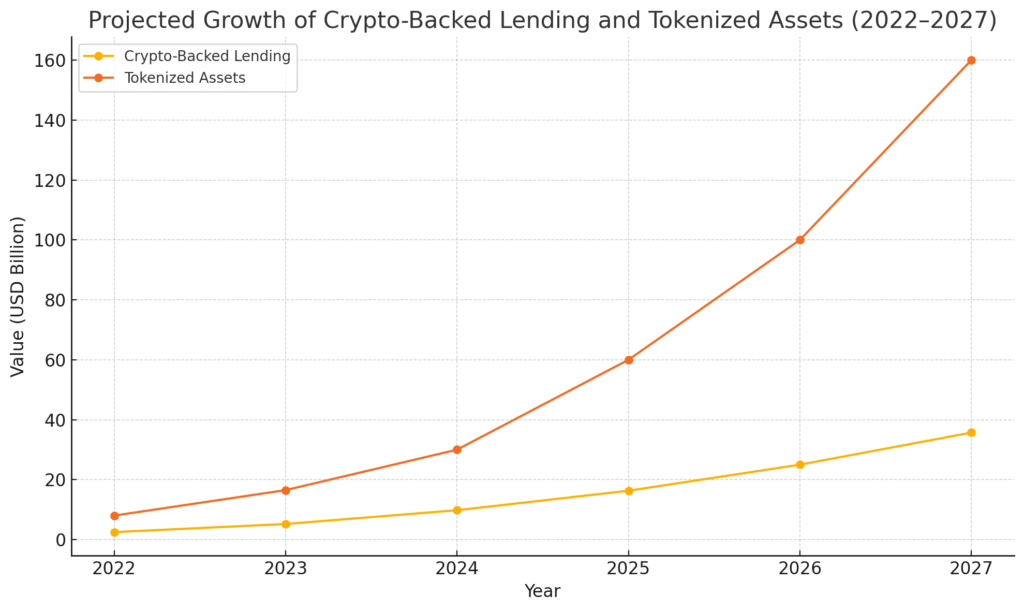

Market analysts believe this trend could be the tip of the iceberg. If JPMorgan succeeds, other banking giants like Morgan Stanley, Citi, and UBS may follow. Combined with the ongoing tokenization of traditional assets and the growing footprint of stablecoins in settlement infrastructure, crypto is becoming deeply embedded into the future of modern banking.

Recap:

On July 22, JPMorgan announced plans to explore crypto-backed lending for wealthy clients. The move reflects rising institutional comfort with crypto and opens the door to mainstream adoption of tokenized finance products.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.