Now Reading: SpaceX-Linked Wallet Moves $268M in Bitcoin, Stirring Market Speculation

-

01

SpaceX-Linked Wallet Moves $268M in Bitcoin, Stirring Market Speculation

SpaceX-Linked Wallet Moves $268M in Bitcoin, Stirring Market Speculation

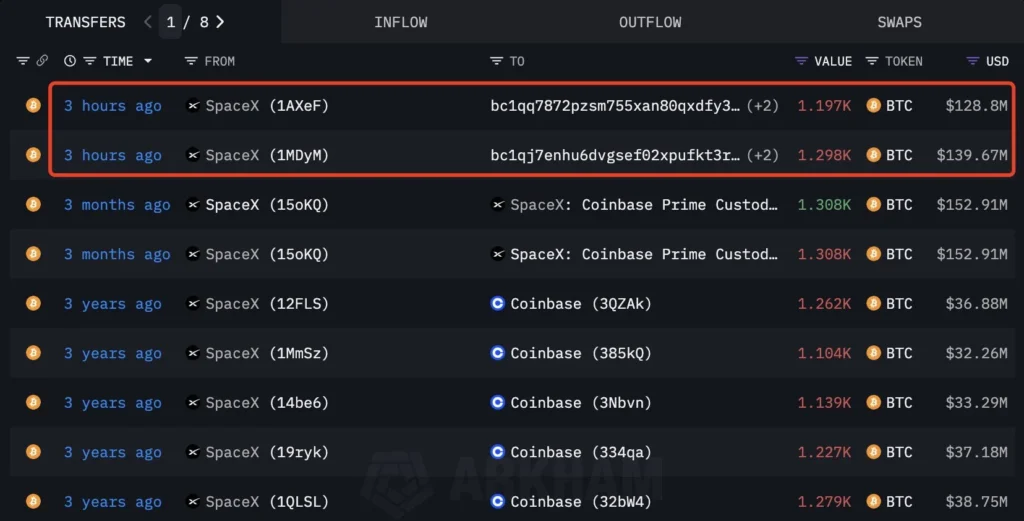

NEW YORK, Oct. 21, 2025 – A blockchain wallet with previous ties to Elon Musk’s SpaceX transferred approximately $268 million in Bitcoin, a significant move that has reignited debate across the digital asset landscape. The transaction appeared on public ledgers late Monday, sending ripples across Bitcoin’s deep waters and prompting immediate speculation about the aerospace giant’s crypto treasury strategy and its potential market impact. This large-scale SpaceX Bitcoin transfer adds a new layer of intrigue to the world of corporate crypto holdings.

Blockchain Data Reveals Major Transfer Linked to SpaceX

On-chain analytics platform Arkham Intelligence first flagged the transaction. The data shows that a wallet, historically associated with SpaceX through prior on-chain activity and public disclosures, moved over 4,100 BTC. The transfer occurred in a single block, timestamped at approximately 22:45 UTC.

Notably, the receiving address is a newly created wallet with no previous transaction history. This pattern often signals an internal treasury reshuffle or a move to a new cold storage solution. However, it could also be a precursor to an over-the-counter (OTC) trade. The wallet in question had been largely dormant since a period of accumulation back in 2023, according to blockchain explorers.

Analysts Debate Possible Motives Behind the Move

The motivation behind the SpaceX Bitcoin transfer remains the central question for market observers. Is SpaceX adjusting its crypto exposure or merely executing an internal transfer for security purposes?

One perspective is that this is a standard treasury management operation. Companies holding significant digital assets periodically move funds to new, more secure addresses to mitigate risks. Conversely, another theory suggests the move could precede a liquidation event, where the company might be de-risking its balance sheet or freeing up capital for other ventures. The destination wallet’s inactivity, however, makes immediate liquidation less probable, though not impossible.

Bitcoin Market Responds to Whale Activity

The market’s reaction to the news was swift, though not extreme. Bitcoin’s price saw a brief, modest dip of around 1.5% in the hour following the news before recovering. Trading volume experienced a noticeable spike on major exchanges as algorithms and day traders reacted to the whale alert.

The move also triggered a flurry of discussion on social media platforms, with investors analyzing the potential implications. As of Tuesday morning, neither SpaceX nor its CEO Elon Musk had issued a public statement on the matter, leaving the market to interpret the on-chain data without official guidance.

SpaceX’s Historical Exposure to Bitcoin

SpaceX’s involvement with Bitcoin is not new. According to a 2023 report from Bloomberg, the private company held Bitcoin on its balance sheet, although the company has never fully disclosed the exact amount. Like Tesla, another of Musk’s ventures, SpaceX embraced digital assets as part of a forward-looking treasury strategy. This history of corporate BTC exposure provides crucial context for the recent transaction, hinting that the company is actively managing its crypto portfolio.

Expert Commentary: Corporate Treasury or Strategy Shift?

Crypto analysts are divided. “This looks more like custodial housekeeping than a market-moving sale,” commented Julian Marks, a strategist at CryptoQuant Analytics. “Sophisticated entities don’t typically move funds to a brand-new wallet to sell on an open exchange. It’s more likely a security upgrade or a transfer to a new custody partner.”

However, others see it as a potential strategic shift. Dr. Alena Petrova, a treasury analyst at KPMG Digital Assets, noted, “Given the current macroeconomic climate, it wouldn’t be surprising if a private firm like SpaceX decided to trim its exposure to volatile assets. This move at least signals they are actively re-evaluating their position.” Those looking to enter the market often seek out the best crypto platforms of 2025 to execute their own strategies.

Regulatory and Institutional Context

The transaction also highlights the ongoing challenge of transparency for large, private companies holding cryptocurrencies. Unlike publicly traded firms, which face stringent SEC disclosure requirements, private entities like SpaceX operate with greater financial opacity. This transfer adds fuel to the discussion about whether non-public companies with significant digital asset holdings need new regulatory frameworks.

Outlook: What This Means for Bitcoin and Corporate Holders

Ultimately, this event serves as a powerful reminder of how large holders can influence market sentiment. While the price impact was contained, the speculation underscores the market’s sensitivity to the actions of major corporate players. It reignites questions about long-term corporate adoption and the strategies firms will employ to manage digital assets. Could this be a prelude to more corporate blockchain transparency? For now, the crypto world is watching the new wallet for its next move.

Key Takeaways

- Major Transfer: A wallet linked to SpaceX moved approximately $268 million in Bitcoin.

- On-Chain Data: The transaction was tracked by analytics platforms like Arkham Intelligence.

- Market Reaction: Bitcoin saw a brief period of increased volatility and trading volume.

- Divided Analysis: Experts are split on whether the move signals a sale or internal treasury management.

- Corporate Holdings: The event renews focus on the transparency and strategy of corporate crypto treasuries.