Now Reading: Synthetix Surges 120% as On-Chain Derivatives Bring New Life to DeFi’s “Dino Coin”

-

01

Synthetix Surges 120% as On-Chain Derivatives Bring New Life to DeFi’s “Dino Coin”

Synthetix Surges 120% as On-Chain Derivatives Bring New Life to DeFi’s “Dino Coin”

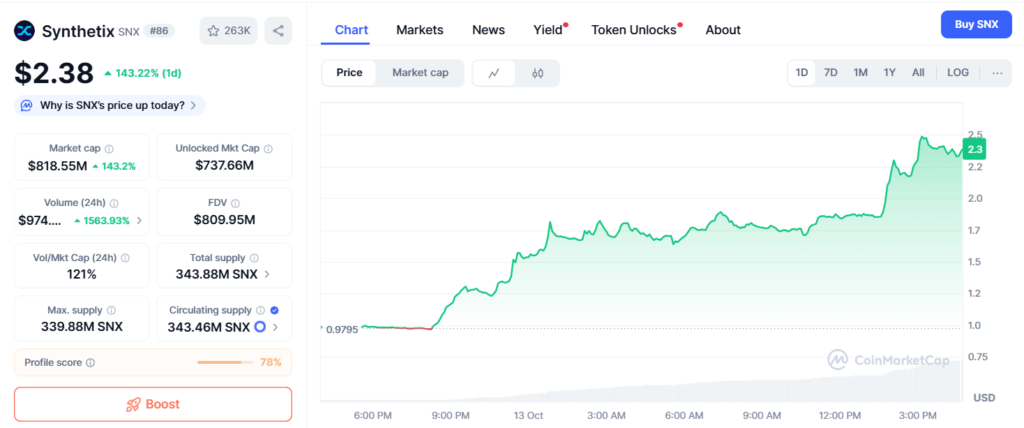

NEW YORK, NY – October 13, 2025 — Synthetix (SNX) is back in the spotlight after months of calm trading. Once dismissed as a relic of the early DeFi boom, the token has jumped more than 120% over the past month. This rise follows renewed enthusiasm for decentralized derivatives and a surge of trading activity on Layer-2 networks.

In mid-September, SNX traded around $2.50. By early October, it touched $5.50 before stabilizing near $5.20. The rally was matched by rising volumes and a sharp increase in total value locked, which now exceeds $1 billion, according to DeFi Llama.

Synthetix’s SNX token surged 120% in 24 hours, fueled by excitement over its upcoming perpetuals DEX launch, reclaiming pre-2022 crash levels. pic.twitter.com/WV3DKIaqP8

— BNN (@brainsnewsnets) October 13, 2025

Much of the momentum comes from Synthetix V3, a major upgrade that improved capital efficiency and strengthened its perpetual-futures markets. Layer-2 integrations with Optimism and Base have helped the protocol lower fees and execute trades faster, making it more competitive with centralized exchanges.

“There’s a clear shift back toward tested and reliable infrastructure,” said Clara Evans, senior analyst at CryptoStrat Research. “Synthetix focused on stability while newer projects chased hype. With scaling solutions now mature, its derivatives are finally reaching their full potential.”

The platform lets users mint synthetic assets, called synths, that mirror real-world prices such as cryptocurrencies, commodities, or currencies. Its perpetual-futures markets have become a growth driver, allowing traders to take leveraged positions while retaining full control of their assets. Upgrades in collateral management and liquidity design pushed daily volumes above $500 million. These improvements also increased the yield for SNX stakers, who earn a share of protocol fees.

“The market is rewarding real performance again,” said Marcus Thorne, managing partner at Hexagon Capital. “When trading grows, fees flow directly to stakers. That mechanism provides genuine yield instead of inflationary token rewards.”

The “dino coin” label, once used jokingly, has become a badge of strength. While many projects from 2020 faded, Synthetix continued refining its governance and infrastructure. Analysts say this persistence shows how the DeFi market is maturing and starting to value proven systems over speculation. Competitors such as GMX and dYdX still lead in some areas, but Synthetix’s consistent reliability and community governance continue to attract traders.

The community’s next focus is to expand tradable assets and connect its derivatives liquidity across more decentralized apps. Future proposals include cross-chain integrations and updated staking models to balance risk and reward. For now, the Synthetix 120% surge DeFi derivatives V3 upgrade story highlights how long-term projects can evolve and regain leadership in a rapidly shifting market.

Recap:

- Synthetix (SNX) climbed 120% in 30 days, stabilizing near $5.20.

- TVL rose above $1 billion after the V3 upgrade launch.

- Perpetual-futures volume exceeded $500 million daily.

- Optimism and Base integrations improved trading speed and costs.

- Analysts see the Synthetix 120% surge DeFi derivatives V3 upgrade as proof that DeFi’s veterans are adapting and thriving again.

Gemini Trade. Secure Crypto on the Go.

SponsoredLooking for a secure and easy way to manage your crypto? Gemini helps you buy, sell, and store digital assets in just a few taps – no stress, no hassle.

With powerful tools, live market tracking, and insured wallets, Gemini gives you peace of mind while keeping you in control of your portfolio – whether you’re new to crypto or a seasoned trader.

Get started for free and make smarter trades with Gemini today.