Now Reading: XRP News Today: SEC Chair Atkins Fuels Hope for Appeal Withdrawal Vote; BTC Soars Past $115K

-

01

XRP News Today: SEC Chair Atkins Fuels Hope for Appeal Withdrawal Vote; BTC Soars Past $115K

XRP News Today: SEC Chair Atkins Fuels Hope for Appeal Withdrawal Vote; BTC Soars Past $115K

The U.S. cryptocurrency landscape witnessed a pivotal shift on Monday, as Securities and Exchange Commission (SEC) Chair Paul Atkins unveiled a sweeping initiative to modernize digital asset regulation amid renewed optimism over the long-running Ripple (XRP) lawsuit. At the same time, Bitcoin (BTC) surged past $115,000, underscoring renewed investor confidence in the sector.

Regulatory Pivot: “Project Crypto” Announced

Speaking at a fintech policy roundtable in Washington, Chair Atkins introduced Project Crypto, a framework aimed at overhauling the regulatory environment surrounding cryptocurrencies and blockchain-based assets.

“We will not watch from the sidelines. The U.S. will lead and build the next chapter of financial innovation right here on home soil,” — Paul Atkins

The announcement aligns with broader political calls to reassert America’s leadership in the global digital asset race, particularly in light of accelerating innovation in Asia and the EU.

Ripple Lawsuit Nears Potential Resolution

Market participants are now closely watching for a potential SEC vote to withdraw its appeal in the closely watched SEC v. Ripple case. The move, if confirmed, could mark the beginning of regulatory détente in the U.S. crypto space.

“If Chair Atkins can unite the commissioners and dismiss the SEC’s Ripple appeal, it would mark a watershed moment, not just for XRP, but for the crypto sector as a whole,” said pro-crypto legal analyst Bill Morgan.

Former SEC attorney Marc Fagel cautioned that such a development would be highly unusual, but not impossible.

“It would almost certainly require a formal internal vote. It’s unusual, but these are unprecedented times for digital asset regulation,” Fagel noted.

With the next closed-door SEC meeting and legal deadlines approaching, speculation is mounting that a formal vote could be imminent. This may potentially end years of litigation between Ripple Labs and the Commission.

Market Reacts: Bitcoin Breaks $115K, XRP Rallies

“The alignment of legal clarity and surging institutional interest could propel XRP into a new bullish phase,” said S. Parks, senior strategist at FXEmpire. “If BTC holds above $115K, the broader crypto ecosystem gets a vital confidence boost.”

Institutional flows into Bitcoin have accelerated in recent weeks, with several large asset managers reportedly increasing allocations amid growing clarity in Washington.

Outlook: Key Triggers Ahead

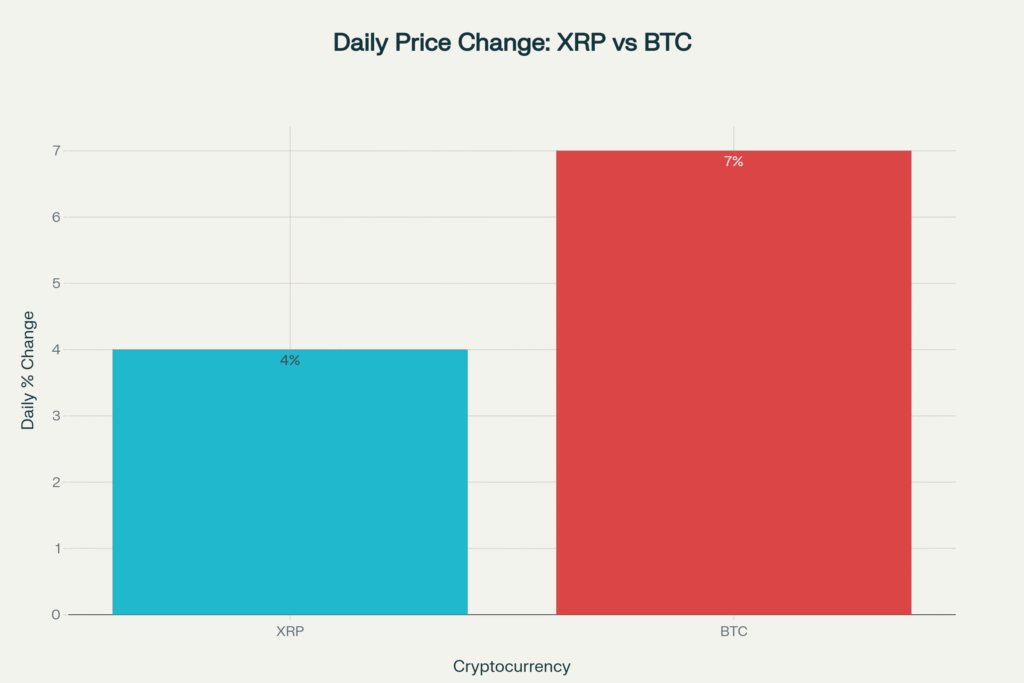

The crypto market responded swiftly. Bitcoin climbed above $115,000 for the first time, while XRP posted a 4% intraday gain, outperforming major altcoins amid broader macro uncertainty.

Investors are now closely monitoring three key developments:

- A potential SEC vote on the Ripple appeal in the coming weeks

- Movement on new crypto legislation such as the bipartisan CLARITY Act

- Continued institutional accumulation of Bitcoin and blue-chip tokens

Recap :

With regulatory thaw underway and bullish momentum gathering pace, the U.S. digital asset market appears to be entering a new era. As lawmakers, regulators, and investors converge on a path forward, the long-term trajectory of crypto in America could be fundamentally reshaped in the months ahead.

Trade Smarter. Anytime, Anywhere

SponsoredDiscover one of the world’s largest crypto-asset exchanges. Whether you’re monitoring the markets or making quick trades, the tools you need are just a few taps away.

Access live crypto price alerts, manage your portfolio, and explore a wide range of top-performing digital assets with low fees and enterprise-grade security.